The United Kingdom’s alcohol duty system underwent a significant reform, aiming to streamline its structure and address public health concerns. The revised system, which came into effect in two phases, notably impacted the taxation of alcoholic beverages. The main objective of these changes was to ensure that alcohol products are taxed more proportionally based on their alcohol content, with stronger drinks facing higher duties. This article provides a detailed analysis of the reform, examining the effects on the UK market and specific alcohol categories, including wine, beer, and spirits, and offering insights into how industry stakeholders are responding.

1. Overview of the UK Alcohol Duty Reform

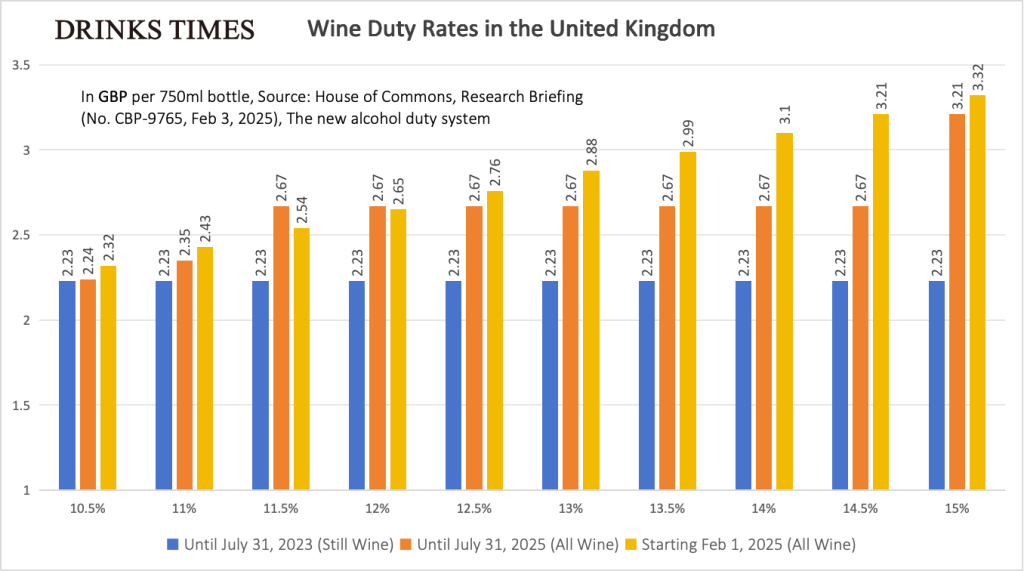

Alcohol duty is a tax charged at the point of production or importation of drinks of alcoholic strength exceeding 1.2% ABV. The new structure introduced in August 2023 and further adjusted in February 2025 taxes drinks based on their alcohol by volume (ABV), with higher-strength drinks incurring higher duty rates.

The major changes to the UK alcohol duty system took place in two stages:

- Phase 1 (Effective August 2023): A new structure was introduced where alcoholic beverages are taxed based on their alcohol by volume (ABV), with the stronger the drink, the higher the duty.

- Phase 2 (Effective February 1, 2025): This phase introduced a standardised administrative process across all alcohol categories, including a significant rise in tax rates for wines with higher alcohol content, especially for wines over 14% ABV.

The most notable change came with the repeal of the temporary easement for wines between 11.5% and 14.5% ABV, which had been introduced in August 2023 to ease the transition. From February 2025, wines between 11.5% and 12% ABV would see a decrease in duty rates, while those over 14% ABV faced an increase of up to £0.54 per bottle, moving from £2.67 to £3.21 per bottle (as per the updated duty rate tables).

2. The Overall Impact of the Duty Reform on the UK Alcohol Market

The implementation of the new duty system is expected to have several effects on the UK alcohol market:

- Market Segmentation and Price Increases: The increased tax burden on stronger wines (especially those above 14% ABV) will likely lead to price increases, particularly affecting high-end wine segments. For instance, wines with an ABV of 14.5% that previously faced £2.67 per bottle in duty will now be taxed £3.21 per bottle starting in February 2025. This could cause a shift in consumer demand toward more affordable options. Conversely, wines between 11.5% and 12% ABV, benefiting from a reduced duty, may see a rise in consumer interest, especially among price-sensitive buyers.

- Consumer Behavior Shifts: The reform is expected to alter consumer purchasing patterns, particularly as the tax burden on high-strength wines increases. Higher-priced wines might see reduced demand as consumers shift to more affordable or lower-alcohol products. The changes could result in a reduction in the consumption of high-strength wines, while more consumers might turn to wines with lower alcohol content, which are now taxed more favorably.

- Potential Changes in Drinking Habits: With the increase in tax on high-alcohol beverages, especially wines above 14% ABV, it’s likely that consumption patterns will shift. Consumers may gradually reduce their intake of high-strength drinks, particularly in social settings where affordability becomes more important. At the same time, the trend towards lower-alcohol options, such as low-alcohol wines and beers, could gain traction, especially among younger generations who are more health-conscious. This may influence purchasing decisions and shape future product offerings in bars and social venues, where consumers increasingly seek lighter, lower-alcohol alternatives.

- Economic Effects on Producers and Retailers: Higher tax rates on stronger wines will put pressure on producers to either absorb the additional costs or pass them on to consumers. This may particularly impact smaller wineries and independent retailers, who could struggle with the increased financial burden of higher tax rates.

3. Impact of the Duty Reform on Specific Alcohol Categories

Wine:

Wines Above 14% ABV: The most significant impact is on wines with an alcohol content above 14%. The increase from £2.67 to £3.21 per bottle for these wines will likely push up retail prices, leading to reduced affordability for consumers, particularly in the premium wine segment. These wines will face increased competition from lower-alcohol options and lower-priced wines.

Wines Between 11.5% and 12% ABV: These wines, which benefit from a reduction in duty rates, could experience a growth in market share. The reduced tax rate makes these wines more attractive to consumers looking for more affordable options. The change could result in a positive shift in consumption toward these products.

Beer and Cider:

Draught Products: One of the most significant aspects of the reform for beer and cider is the introduction of draught relief, which reduces the duty on draft beer and cider. The tax relief for products served in pubs and bars is intended to support the hospitality industry. For example, for beers and ciders between 3.5% and 8.4% ABV, the tax relief can reduce the duty by as much as 13.9% compared to bottled or canned products. This could stimulate demand for draught beers, benefiting publicans and consumers alike.

Small Breweries and Cider Producers: The small producer relief (SPR) is another critical element of the reform, designed to assist smaller beer and cider producers. By lowering the duty on production volumes under 450,000 litres of pure alcohol, smaller producers will have some financial relief. This will likely result in increased competition from smaller producers, as they can now offer their products at more competitive prices.

Spirits:

While spirits did not see as large a change in tax rates, the increase in overall tax levels across the alcoholic drinks market could still affect the pricing strategies for premium spirits. However, since spirits tend to have higher profit margins, their ability to absorb or pass on the increased costs may be less impacted than wines and beers.

4. Industry Reactions to the Duty Reform

- Wine and Spirits Industry: The wine and spirits industry has expressed concerns over the tax increases, particularly the end of the transitional easement for wines. Industry representatives argue that these changes could increase costs significantly, especially for premium wine producers. They have also voiced concerns about the additional administrative burden, which could further increase production costs for smaller producers.

- Beer and Cider Industry: The beer industry, particularly small brewers, has welcomed the introduction of small producer relief and draught duty relief. These measures are seen as crucial in helping small brewers and cider makers remain competitive against larger producers. However, there are concerns that the increase in taxes on higher-strength drinks could affect consumer preferences and overall sales.

- Public Health Advocates: Public health organizations have largely welcomed the new tax system, viewing it as a step towards reducing alcohol misuse. By taxing stronger drinks more heavily, the government aims to discourage excessive alcohol consumption, which is linked to numerous health problems. Public health groups argue that higher taxes on high-strength drinks could lead to a reduction in alcohol-related harms and lower pressure on the NHS.

5. Adapting to a New Era of Alcohol Taxation

The UK’s alcohol duty reform is a significant shift in the country’s approach to alcohol taxation, with far-reaching implications for the market and various stakeholders. The increased tax burden on stronger wines and spirits will likely result in higher prices, which could reduce demand in the premium market while boosting interest in lower-alcohol products. On the other hand, the introduction of tax reliefs for small producers and draught products provides opportunities for growth in certain sectors, particularly for small brewers and cider makers.

As the reform unfolds, it will be essential to monitor its long-term effects on the alcohol market, especially as the industry adapts to higher taxes and evolving consumer preferences. The new system aims to strike a balance between generating public revenue and achieving public health goals, but its success will depend on how well the market adapts and how the consumer behavior shifts in response to these changes.

References

- UK Parliament: The new alcohol duty system (February 3, 2025)

- CBP-9765 full report (.pdf)