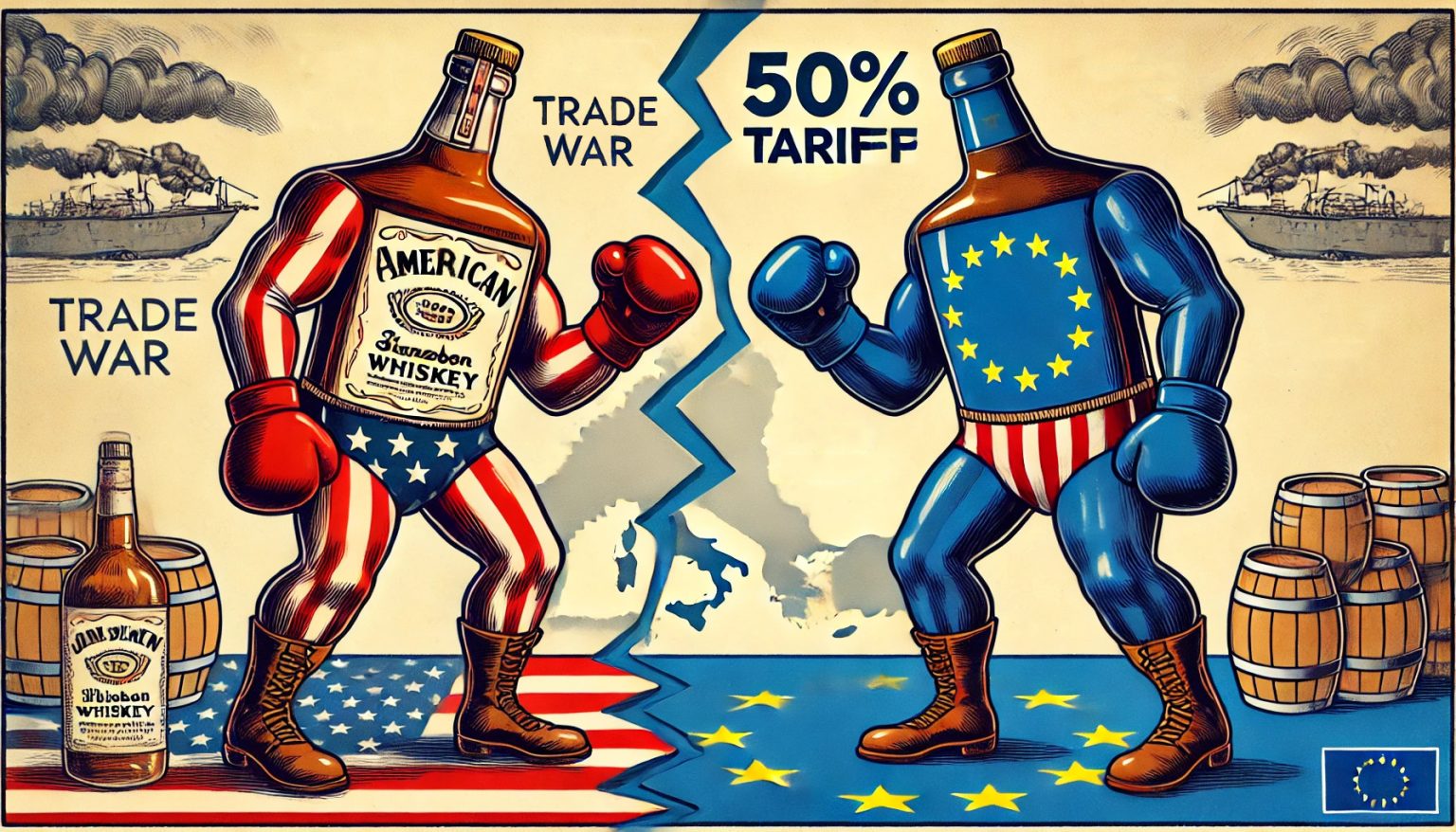

On March 12, 2025, the European Union dropped a bombshell: a 50% tariff on American whiskey and other spirits, set to take effect April 1, as retaliation for US tariffs on steel and aluminum. This move reignites a trade dispute that has long ensnared the spirits industry as an unwilling casualty. With American whiskey potentially flooding the EU market before the deadline, and a second wave of tariffs looming, the transatlantic spirits trade – once a beacon of tariff-free prosperity – faces a turbulent future. “Why must spirits always be the bargaining chip?” laments Pauline Bastidon of spiritsEUROPE. For an industry already battered by geopolitical tensions and slowing markets, the stakes couldn’t be higher.

A Trade Dispute Rekindled

The roots of this clash stretch back to 2018, when the US imposed tariffs on EU steel and aluminum, prompting the EU to slap a 25% duty on American whiskey. Exports to the EU – the largest market for US whiskey – plummeted 20%, from $552 million to $440 million by 2021. A truce in 2021 suspended those tariffs, and the reprieve paid off: American whiskey exports surged nearly 60% over the past three years, climbing to $699 million in 2024. But the harmony was short-lived. New US tariffs affecting €18 billion of EU exports have triggered a two-phase EU response. First, the reinstatement of a 50% tariff on whiskey starting April 1. Second, a broader package targeting US agri-food products – including gin, liqueurs, and wines – pending consultation until March 26. The spirits sector, once again, finds itself in the crosshairs.

Voices of Alarm

The announcement has sparked a chorus of dismay from both sides of the Atlantic. SpiritsEUROPE, representing EU producers, calls the tariffs “hugely damaging,” warning of job losses and investment setbacks at a time when the sector is already reeling. Bastidon highlights the 1997 zero-for-zero agreement that fueled a 450% boom in transatlantic spirits trade until 2018, urging policymakers to “keep spirits out of unrelated disputes.” Across the pond, Chris Swonger, president of the Distilled Spirits Council (DISCUS), echoes the sentiment. “These tariffs will severely undercut our efforts to rebuild exports,” he says, noting the industry’s $200 billion economic footprint and 1.7 million US jobs. Both groups, alongside the Toasts Not Tariffs Coalition, plead for a return to the tariff-free model that once defined this thriving trade.

Subscribe to our newsletter

Ripple Effects on the Market

The looming April 1 deadline could set off a scramble. Importers may accelerate shipments to beat the tariff, potentially causing a late-March spike in American whiskey imports – echoing the stockpiling seen before the 2018 tariffs took hold. Yet once the 50% duty kicks in, demand could crater as prices soar, leaving shelves stocked but sales stagnant. The 2018-2021 precedent is stark: a 25% tariff slashed US whiskey exports by 20% in three years; a 50% rate could halve that volume again. Long-term, the fallout deepens. Iconic spirits like Bourbon and Tennessee Whiskey – tied to their regions by law – can’t shift production, risking permanent market share losses to rivals like Canada or Japan. EU firms producing American brands locally, and US distilleries in Europe, face similar threats to jobs and investment. As Swonger warns, “This isn’t just about bottles – it’s about farmers, bartenders, and rural economies.”

A Pivotal Moment Ahead

Hope hinges on March 14, when EU Trade Commissioner Maroš Šefčovič and US Commerce Secretary Howard Lutnick are set to discuss the spiraling dispute. The talks could focus on a temporary tariff freeze or a broader steel-and-aluminum resolution – offering a lifeline to the spirits trade. The Toasts Not Tariffs Coalition calls it “a positive step,” but the outcome is far from certain. Success could pave the way back to the 1997 zero-for-zero model, a proven winner for both sides. Failure, however, risks escalation. President Trump’s threat of a 200% tariff on EU spirits looms large; if enacted, it could devastate European exports like Cognac and Irish whiskey, triggering a vicious cycle of retaliation. “De-escalate now,” Bastidon urges, “and keep spirits out of the crossfire.” Swonger adds, “Toasts, not tariffs.”

The Road Ahead for Spirits Trade

The transatlantic spirits market stands at a crossroads. Once a symbol of open trade – binding the US and EU through shared investment, heritage, and growth – it now teeters under the weight of retaliatory tariffs. The next few weeks will be decisive. Will the March 14 talks yield a breakthrough, or will April 1 mark the start of a new economic strain? For an industry that’s weathered disruptions before, resilience is key – but resolution is urgent. As casks age in Kentucky and Cognac, the question lingers: can policymakers raise a glass to cooperation, or will this dispute leave a bitter aftertaste? The clock is ticking, and the spirits world watches with bated breath.